The Importance of Segmentation for Collections in Situations Like Domestic Violence

In the world of debt collection, sensitivity and a nuanced approach are crucial, especially when dealing with vulnerable individuals such as those affected by domestic violence. A standardised, one-size-fits-all collection strategy can unintentionally cause harm and exacerbate financial distress for those already in precarious situations. This is where segmentation for debt collections becomes an invaluable tool, allowing organisations like CollectXpert to tailor strategies, communicate with care, and provide appropriate support to those who need it most.

Understanding Segmentation in Debt Collection

Segmentation in debt collection involves categorising debtors based on various criteria, such as financial situation, repayment behaviour, communication preferences, and vulnerability status. This approach enables collection agencies, financial institutions, and service providers to personalise their communication and engagement strategies. Instead of sending generic collection letters or making standardised phone calls, a segmented approach takes into account the unique needs and circumstances of each debtor, fostering more empathetic and effective interactions.

Why Segmentation Matters in Cases of Domestic Violence

When domestic violence is a factor, the need for segmentation becomes even more critical. Victims of domestic violence often face severe financial abuse alongside physical and emotional trauma. Abusers may control finances, accrue debt in the victim’s name, or restrict access to money, making it nearly impossible for the victim to manage financial obligations. In such circumstances, a generic debt collection approach can lead to significant harm, increasing the victim’s distress and potentially exposing them to further danger.

By implementing segmentation in debt collections, CollectXpert can:

- Identify Vulnerable Individuals: The CRM is the future of debt collection as it allows collection agents to identify individuals and flag them who may be experiencing domestic violence.

- Tailor Communication Strategies: Victims of domestic violence may have limited access to communication channels or may not feel safe receiving certain types of communication. With segmentation, CollectXpert can adjust its contact methods to align with the safety and comfort of the debtor. For example, instead of sending letters or making phone calls, other methods of communication can be utilised, such as secure online portals or emails.

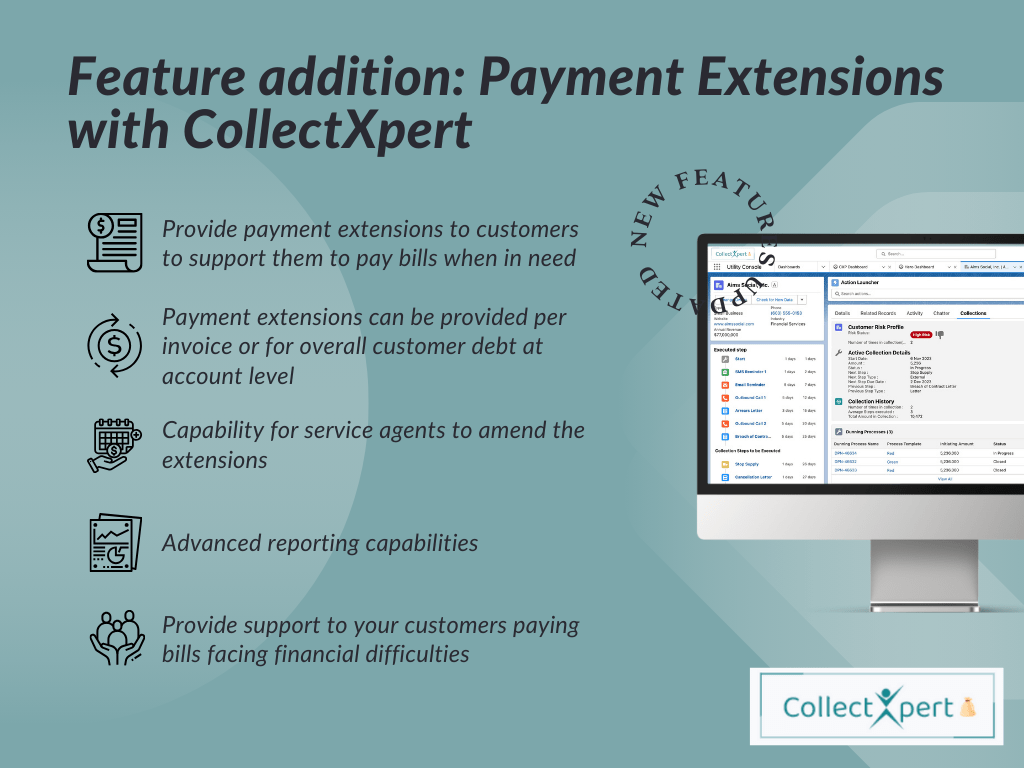

- Provide Specialised Support and Resources: Segmentation helps identify individuals who require more than just financial solutions. Offering payment extensions and options to have a payment plan, can be a crucial lifeline.

- Implement Flexible Payment Arrangements: Victims of domestic violence often face financial instability, making it challenging to adhere to standard repayment plans. This flexibility not only helps manage debt but also empowers individuals to regain control over their financial lives.

- Ensure Confidentiality and Security: One of the most critical aspects of handling domestic violence cases is maintaining the confidentiality and security of the victim’s information. The CRM ensures that their data is handled with extra caution, safeguarding them from potential breaches that could compromise their safety. This includes using secure communication channels and ensuring that no sensitive information is inadvertently disclosed.

The Ethical Imperative for Segmented Approaches

Segmentation in collections is not just a strategic advantage; it is an ethical necessity. Organisations have a lot of challenges while collecting debt and have a responsibility to recognise the diverse situations of their customers and respond with empathy and understanding. For victims of domestic violence, an insensitive approach can lead to devastating consequences, including the risk of further abuse or financial ruin. It is crucial for the collection agents, to choose the right Debt Collection Platform, CollectXpert to adopt a segmented approach that prioritises the well-being of individuals while ensuring effective debt recovery.

A Call for Change in Debt Collection Practices

The need for modern debt collection software with AI, particularly in sensitive situations such as domestic violence, is vital. By adopting segmented approaches, CollectXpert can ensure it is not only efficient in debt recovery efforts but also compassionate and supportive of those in vulnerable situations. It is time for the business to drive success, and move beyond standard practices to embrace a more nuanced, ethical approach that genuinely serves the diverse needs of all individuals.

CollectXpert is committed to ethical and sensitive debt collection practices. By leveraging our expertise in modern debt-collection management and comprehensive service offerings, we help organisations build systems that are both effective and empathetic. To learn more about how we can support your organisation in adopting segmented collection practices, contact us today.