A Guide to Choosing the Right Debt Collection Automation Software

In today’s fast-paced business environment, managing debt collection efficiently is crucial for maintaining cash flow and ensuring financial stability. Debt collection automation software offers businesses the ability to streamline and optimise their debt collection processes. This can be done by implementing dunning and collections automation, saving time and resources while improving collections effectiveness. However, with a plethora of options available in the market, selecting the right debt collection automation software can be daunting. In this blog post, we’ll provide a comprehensive guide to help you navigate the selection process and choose the best solution for your business.

Assess Your Business Needs:

Before diving into the selection process, take the time to assess your business’s specific requirements and challenges for your debt collection automation. Consider factors such as the volume of outstanding debts, the complexity of your collections workflows, integration with existing systems, compliance requirements, dunning and collections requirements, and budget constraints. Identifying your unique needs will help you narrow down your options and focus on solutions that align with your objectives.

Define Key Features and Functionality:

Once you have a clear understanding of your business needs, outline the key features and functionality you require in a debt collection automation software. Some essential features to consider include:

- Automated Communication: Look for software that enables automated communication with debtors via email, SMS, or voice messaging, allowing you to reach out to customers efficiently.

- Customisable Workflows: Choose a solution that offers customizable debt collection workflows to adapt to your specific collections processes and business requirements.

- Compliance Management: Ensure that the collection software complies with relevant regulatory requirements, such as the Fair Debt Collection Practices Act (FDCPA) or GDPR, to avoid legal issues.

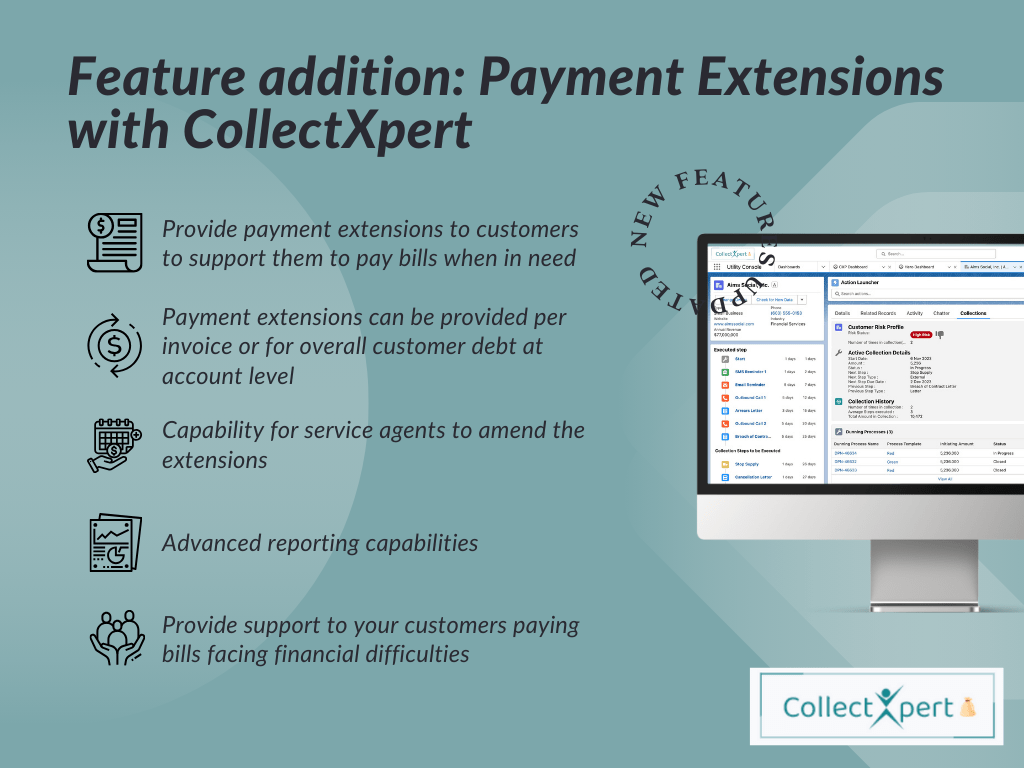

- Reporting and Analytics: Select a debt collection platform that provides robust reporting and analytics capabilities to track collections performance, identify trends, and make data-driven decisions.

- Integration Capabilities: Consider whether the debt collection software integrates seamlessly with your existing systems, via a debt collection plugin such as CRM or accounting software, to facilitate data sharing and streamline operations.

- Scalability: Look for a solution that can scale with your business as it grows, accommodating increased volumes of debt and expanding debt collections operations.

- AI Capability: Smart debt collection software with AI capability utilises predictive analytics to forecast customer behaviour, segmenting clients for personalised communication and optimising contact strategies. These solutions enhance risk assessment, continuously improving collection processes while minimising manual effort, ultimately boosting debt recovery rates and refining customer experiences.

Research and Compare Solutions:

Once you’ve defined your requirements and identified key features, conduct thorough research to explore available debt collection automation software options with customisable dunning and collections automation. Consider factors such as vendor reputation, customer reviews, product demonstrations, and case studies to evaluate each solution’s suitability for your business. Create a shortlist of potential vendors and compare their offerings based on your predefined criteria.

Request Demos and Trial Periods:

To gain a deeper understanding of each software solution’s capabilities, request product demonstrations from shortlisted vendors. During the demos, ask specific questions about how the software addresses your business needs for dunning and collections automation, and watch for how it performs in real-world scenarios. Additionally, inquire about trial periods or pilot programs to test the software in your environment before making a final decision.

Consider Total Cost of Ownership (TCO):

When evaluating debt collection automation software, consider not only the upfront costs but also the total cost of ownership (TCO) over the long term. Take into account factors such as licensing fees, implementation costs, debt collection plugin implementation costs, ongoing support and maintenance, and any additional expenses associated with customization or integration. Choose a solution that offers a favourable balance between features, functionality, and cost-effectiveness.

Seek References and Recommendations:

Before making a final decision, reach out to existing customers of the software vendors to gather feedback and insights into their experiences. Ask for references and recommendations from businesses similar to yours that have successfully implemented debt collection software. Hearing firsthand accounts of how the software has helped other organisations can provide valuable insights and inform your decision-making process.

Selecting the right debt collection automation software is a critical decision that can have a significant impact on your business’s collections efficiency and overall financial health. By following the steps outlined in this guide and conducting thorough research and evaluation, you can confidently choose a solution that meets your business needs, improves collections effectiveness, and drives success.