Collections Management: Solving Traditional Collections Challenges with CollectXpert

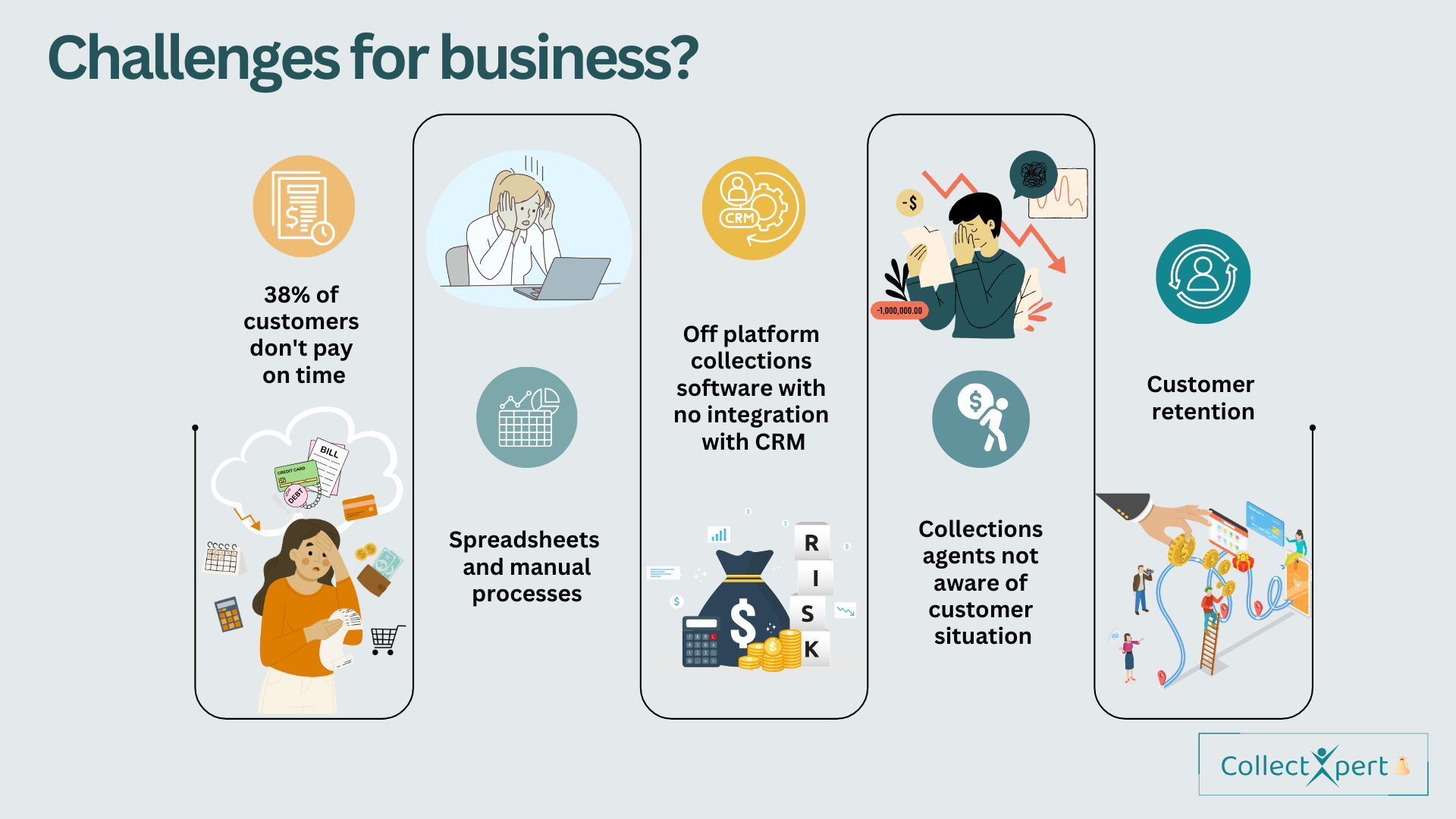

Collections Management: Let’s understand why we need automation? In traditional collections management, businesses of all sizes face a multitude of challenges. This hinders their efficiency, impacts cash flow management, and compromises customer satisfaction. Manual processes, fragmented systems, and limited visibility into customer interactions have long plagued various organizations, yet solutions have been amazingly slow to evolve. Collections management is considered to be one of the overlooked segments of business operations, which certainly requires a modern approach to address its complexities and unlock its potential for revenue generation. CollectXpert, a comprehensive Salesforce Debt Management CRM solution, transforms collections management with its robust feature set, facilitating streamlined operations and ultimately enhancing business ROI.- Manual Processes and Inefficiencies: Traditional collections management methods rely heavily on manual tasks, leading to inefficiencies, errors, and delays. CollectXpert automates these processes, reducing manual intervention, streamlining workflows, segmentations, and enhancing operational efficiency. By automating reminders, better communications, and minimizing errors, CollectXpert ensures that debt collection operations run smoothly and seamlessly.

- Limited Visibility and Data Silos: In traditional collections management systems, data is often siloed across multiple platforms, making it challenging to gain a comprehensive view of customer interactions, prior communications, and payment histories. CollectXpert Debt Collection CRM centralizes all collection-related data within a unified platform, providing agents with a 360-degree view of each customer. With access to real-time data and actionable insights, agents can make informed decisions, tailor collection strategies, and drive better outcomes for businesses of any scale.

- Poor Cash Flow Management: Delayed payments and outstanding receivables can significantly impact cash flow, hindering business growth and sustainability. CollectXpert assists in expediting cash flow by automating debt collection payment reminders, which ultimately optimizes turnaround time, and hence reduces overall outstanding debts.

- Inadequate Customer Communication: In traditional collections management methods, customer communication is often generic, impersonal, and infrequent, leading to dissatisfaction and disengagement. CollectXpert revolutionizes customer communication by delivering personalized, timely, and targeted messages tailored to each customer’s preferences and needs. By providing proactive support, various tailored segmentations, and transparent communication, CollectXpert’s Customer-Centric Debt Collection enhances customer satisfaction and fosters stronger relationships for businesses across all sectors.

- Compliance Risks and Regulatory Challenges: Compliance violations and regulatory challenges pose significant risks to businesses, leading to fines, penalties, and reputational damage. CollectXpert mitigates these risks by automating compliance checks, maintaining detailed audit trails, and safeguarding sensitive data.

In summary, traditional collections management methods present significant challenges that hinder business growth and profitability across all sectors. However, with Salesforce Debt Collection software CollectXpert, these challenges are swiftly addressed. Paving the way for streamlined operations, accelerated cash flow, and elevated customer satisfaction for businesses across all industries and sizes. By automating processes, tailored segmentations, real time visibility of customers, enhancing customer communication, and ensuring compliance, CollectXpert empowers businesses to overcome traditional collections challenges and thrive in today’s competitive landscape.