Another customer with overdues?

How you can follow up without having to follow up?

We all have customer with overdues, and many of them need a reminder about a bill from time to time. This is one of the common challenges business have. On many occasions, a missed bill is exactly that – it was put into the wrong tray (B2B) or fell down the back of the hallway table (B2C) – either way, it was unintentional. A simple reminder, or maybe 2, will get everything back on track.

Reminders can be simple, a templated message emailed out or texted – which we use might depend on the type of customers – segmenting customers and tailoring how to reach out to them is a whole other topic – and maybe we would do one followed by the other. This is where we first start to look – modern and smart automated collections.

Invoicing platforms often include Out Of The Box reminders, these are a great first step for automated collections. Many times though, your customer base will respond better to something more flexible. If an emailed invoice didn’t prompt payment, then another email from the same address that looks almost identical might not work either.

CollectXpert provides an automated debt collections platform for future smarts (AI, CRM, Data) that plugs in alongside your invoicing platform and is built on Salesforce – the World’s largest, most powerful CRM.

Automating simple things is simple

This is just how it sounds. If you think about your overdue customers, and look over what reminders are currently in use, and figure out what works best then we can design an automated collections strategy that follows these guidelines. We know collections, and you know your customers – between us we’ll come up with a solid plan. Now for different customers, we might follow up differently (see our customer segmentation blog for some starter ideas) but the basic idea is:

- after X days we reach out via Communication Method A,

- after Y days (if there still hasn’t been a payment) we reach out via Communication Method B

Email / SMS / letter are the obvious Communication Methods for automated collections these days, but there’s more to it than that.

Automating complex things can be simple too

In some circumstances, we know another Email / SMS / letter is unlikely to achieve anything that the last 3-4 haven’t. This is where collections often move into manual review stages – but a lot of scenarios are well suited to modern automation ways, instead of traditional follow-ups!

An account that is more than a month in arrears, instead of notifying an Accounts Receivable team to review and action according to their policies – we can automate that review. Automated collections can analyse a customer’s account, and dynamically apply next steps from what we know works. This could be different steps depending on:

- Overdue period – after a certain period reminders and the like become cancellation alerts or restriction of supply letters

- Overdue amount – an amount beyond a certain limit might need a review, or even legal sign off before a templated letter is sent

- Frequency of late payments – if a customer is a frequent late payer, we might use an accelerated timeline for reminders

- Geographic / regulatory region – certain regions might have expectations / requirements around collections, and if an area is experiencing hardship (flood, fire, hurricane) we might apply a specially designed collections strategy (see how we manage Payment Extension)

- Customer Type – we may have customers who belong to completely different cohorts, such as resellers or similar that have assigned Account Managers – a simple phone call to their contact might resolve this faster than 10 emails!

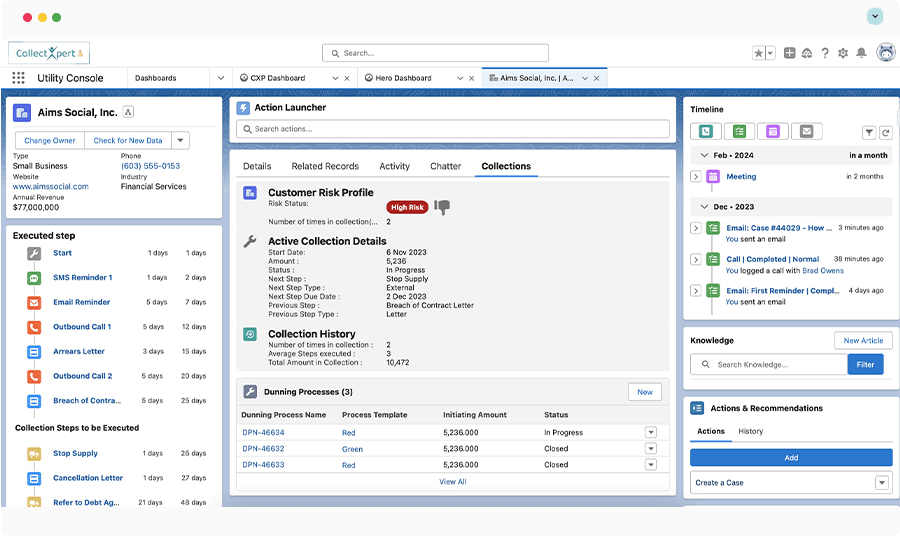

Your agents will all have access to this summary as soon as they open an account in Salesforce as well, Out Of The Box CollectXpert includes a CRM Customer 360 Collections View – so that any agent that is in contact with your customer (inbound or outbound) can see amounts, steps taken and upcoming along with longer term collections history.

With Right Debt Collection Automation Software, we can automate collections for all of this – collection steps used by the strategy that applies directly to that customer and their situation!

- Email / SMS / Letter – via your existing send platforms

- Calls – via OOTB Salesforce record assignment, or automated diallers via your IVR

- Document generation – leveraging existing common DocGen tools

- Team Review – with OOTB Salesforce Queues.

What does this mean?

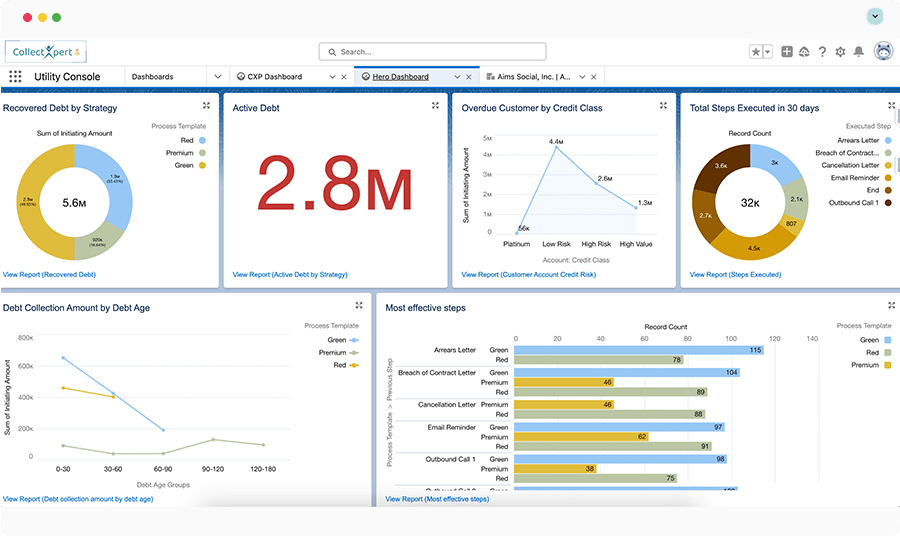

If you have large amounts of overdue accounts, particularly long term overdue accounts (180 days and over) then get in touch – it’s likely that we can help reduce that amount, and reduce how much time is spent collecting on each account. If that data just isn’t quantifiable at the moment, we can help with that too – CollectXpert includes dashboards that give you insights into the current

- Total Debt

- Debt Age brackets

- Debt across customer cohorts

- Most effective collection steps per collections strategy