Features

Automate Collections with Intelligence

Advanced Automation for Seamless Debt Collections

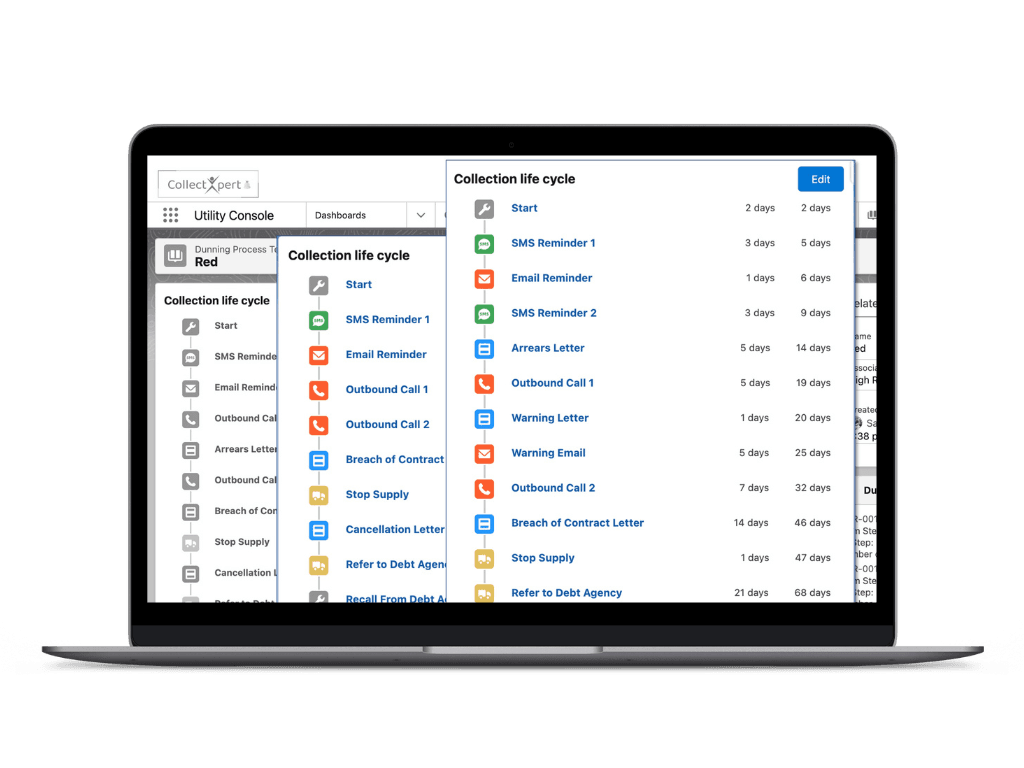

Rule-based collections engine

Automate actions and drives consistent decisions across the collections lifecycle

Automation processor

Orchestrates tasks, reminders, and outcomes at scale, without manual effort

Low-code/No-code

Business control lets the update of the workflows faster, without any developer's assistance

Insights that Drive Success

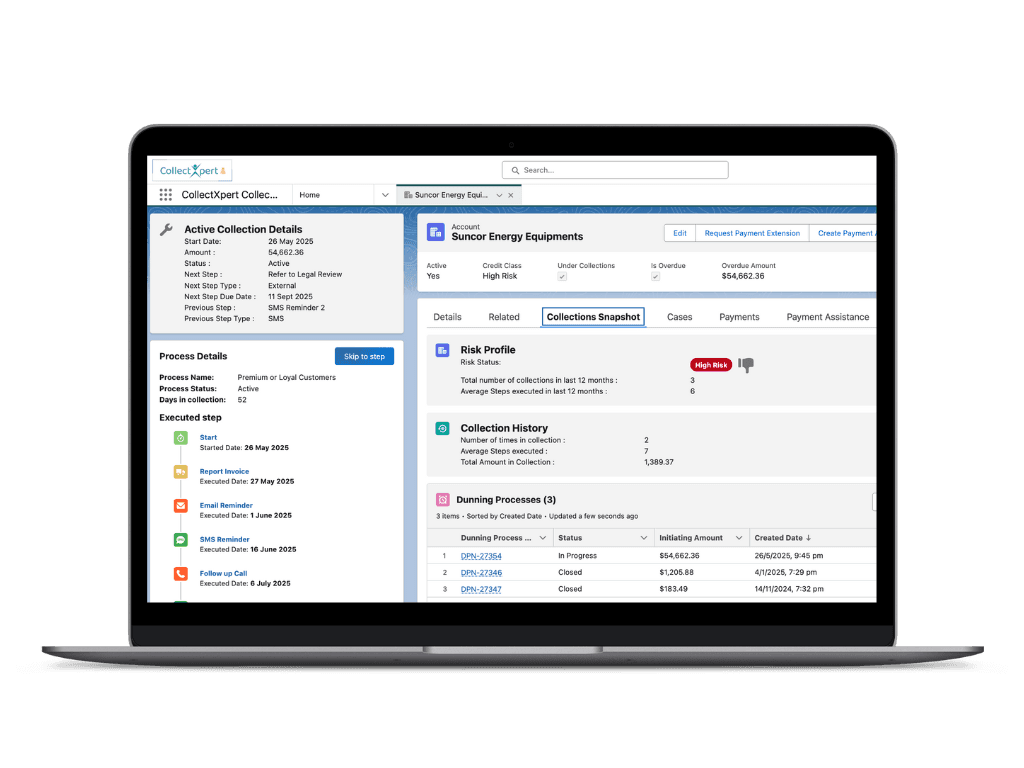

Customer 360° View to Inform Strategic Engagement

Customer 360

CollectXpert's snapshots surfaces risk profile, history, balances, and comms for precise, timely outreach

Advanced smart segmentations

Targets by risk profile, demographics, and vulnerability flags for higher hit-rates

Real-time reports & dashboards

Leverage customizable dashboards to monitor productivity, KPIs, and any-specific compliance metrics

Engage Smarter, Recover Faster

Omnichannel Outreach and Flexible Payment Options

Omni-channel Outreach

Email, SMS, letters, tasks, cases, calling lists, and personalized templates - all in one place

Plug & Play API Ecosystem

Connect with LMS, payment gateways, telephony providers, and ERP platforms using our pre-built connectors or APIs

Payment Assistance

Offer payment plans and extensions tailored to a customer’s ability to repay for better recovery outcomes

Built for Control and Compliance

Tailored, Secure, and Scalable Collection Framework

Hardship & vulnerability workflows

Advanced workflows and dispute management ensure responsible collections with customer sensitivity

Pause/Resume/Skip workflows

Pause, auto resume and skip dunning actions, while maintaining full audit trails

Role-Based Access & Compliance

Enforce role-based access control and audit trails to support regulatory adherence and ethical data handling