The Power of a Quick Reminder: Turning Late Payments into On-Time Payments

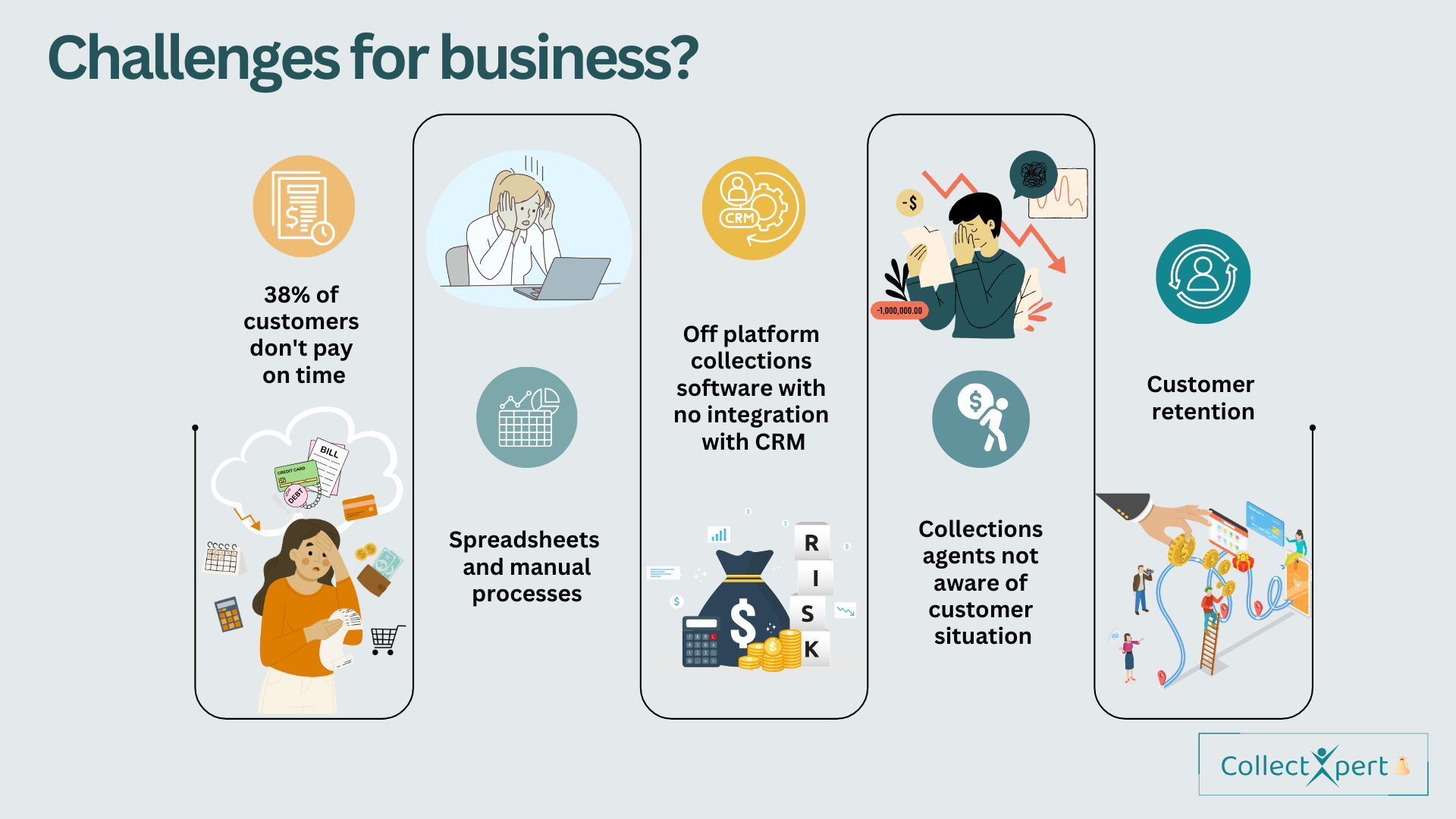

Research shows that over 60% of B2B invoices are paid late, causing unnecessary financial strain. Late payments are more than just an inconvenience; they disrupt cash flow, strain customer relationships, and create additional administrative burdens. Surprisingly, the solution to this problem can often be as simple as a timely reminder. Here’s why a quick nudge can make all the difference and how CollectXpert can streamline this process.

Why Timely Reminders Matter

Avoiding Oversights: Life is busy, and customers can easily forget about an upcoming payment. A gentle reminder ensures your invoice doesn’t slip through the cracks, helping customers stay on track and avoid unnecessary late fees.

Maintaining Positive Customer Relationships: Friendly reminders demonstrate professionalism and show your commitment to clear communication. This proactive approach strengthens trust and reduces the awkwardness of chasing overdue payments.

Speeding Up Cash Flow: Timely follow-ups encourage faster payments, reducing the time between invoicing and collection. This improved cash flow supports your organisation’s financial health and operational stability.

Reducing Administrative Work: Late payments often lead to additional traditional follow-ups, escalating the workload for your accounts receivable team. Sending reminders early minimises the need for repeated outreach and streamlines the entire process.

How CollectXpert Helps You Stay Ahead

CollectXpert, our collections tool, takes the hassle out of sending payment reminders manually. With its robust automation features, you can:

- Set Up Automated Reminders: Schedule reminders to be sent before, on, or after the due date. Tailor the frequency and tone to suit your customer relationships.

- Customise Messaging: Craft professional and personalised messages that align with your brand’s voice, ensuring reminders feel helpful rather than intrusive.

- Minimise Human Error With automated workflows, CollectXpert ensures no customer is overlooked, reducing the risk of missed communications and improving overall efficiency.

Real-World Success

One of our clients, a mid-sized wholesale distributor, struggled with late payments impacting their cash flow. After implementing CollectXpert, they saw a 35% reduction in overdue invoices within the first three months. Automated reminders helped them maintain timely communication with customers, leading to faster payments and improved relationships.

A quick reminder can be the difference between a late payment and an on-time one. By leveraging automation with CollectXpert, your organisation can ensure timely reminders, foster better customer relationships, and maintain healthy cash flow. Don’t let late payments disrupt your business—take control with CollectXpert.

Ready to optimise your collections process?

Contact us today to schedule a demo and see how CollectXpert can transform your collections strategy.