Enhancing Debt Collection Strategies: Overcoming Common Challenges in the Industry

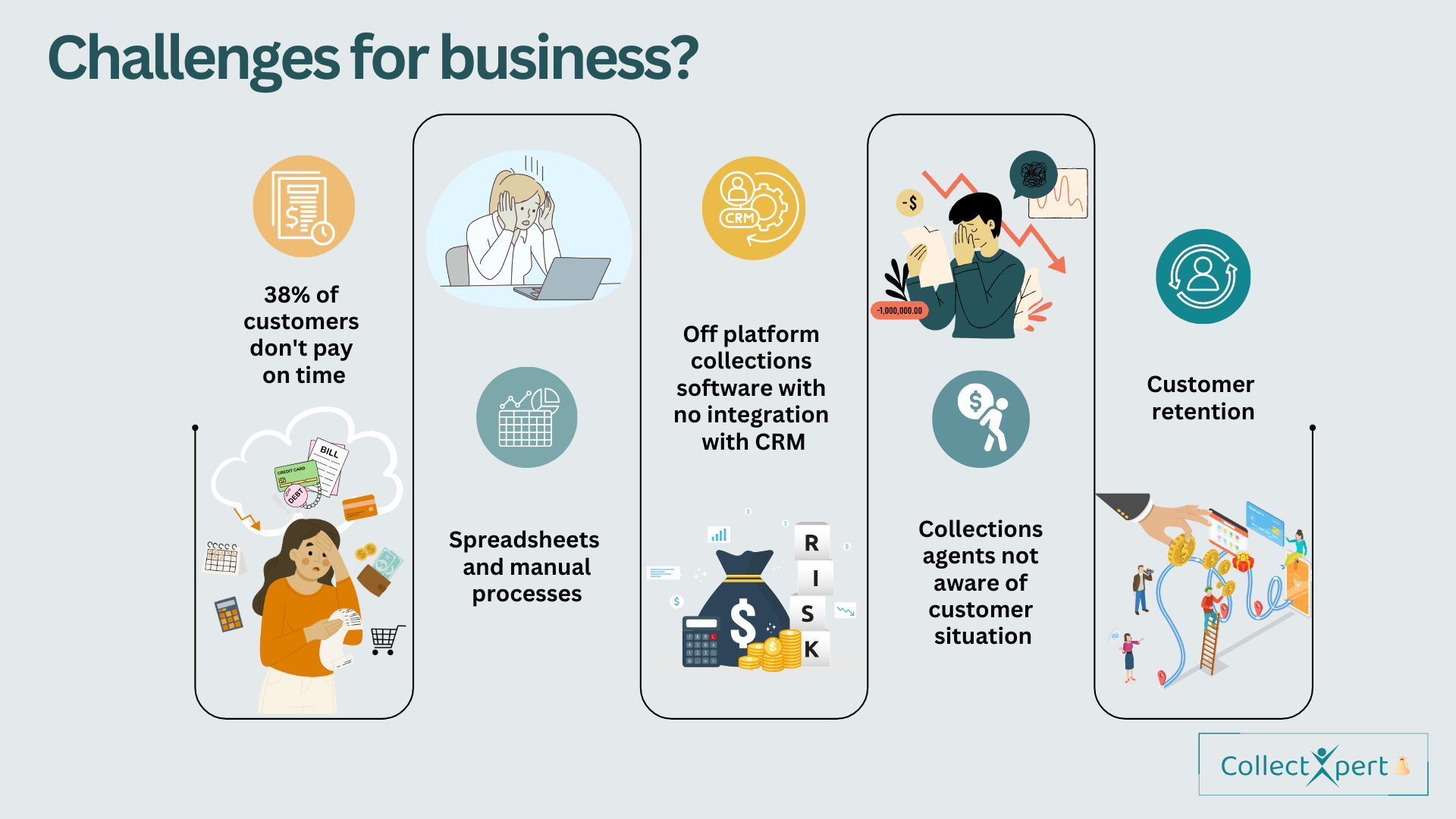

In today’s fast-paced business environment, effective debt collection is essential for maintaining a healthy cash flow. However, many organisations still face significant challenges in this area, impacting both their bottom line and customer relationships. Did you know that 38% of customers don’t pay on time? This statistic alone highlights the critical need for a more streamlined and customer-centric approach to collections. In this blog, we’ll explore the key issues currently hindering debt recovery efforts and how modern solutions like CollectXpert can help address them.

The Inefficiencies of Spreadsheets and Manual Processes

Many businesses still rely on spreadsheets and manual processes to manage their collections. While these tools may have sufficed in the past, they are now outdated and prone to errors. Manual entry increases the risk of mistakes, resulting in incorrect balances, missed follow-ups, and poor communication with customers. These inefficiencies can lead to delayed payments, frustrated customers, and, ultimately, revenue loss.

Spreadsheets lack the ability to provide real-time updates or automate repetitive tasks, leading to a significant waste of time and resources. As collections teams spend more time on administrative tasks, they have less time to focus on strategic initiatives that could improve recovery rates and customer satisfaction.

The Problem with Off-Platform Collections Software

Another common issue is the use of off-platform collections software that doesn’t integrate with a company’s Customer Relationship Management (CRM) system. When debt collection systems operate in silos, crucial customer information gets fragmented, making it difficult for collections agents to have a complete view of the customer’s situation. This lack of integration results in disconnected and often duplicated efforts, reducing the overall efficiency of collections processes.

Without CRM integration, collections teams miss out on valuable customer insights, such as payment history, communication preferences, and previous interactions. This lack of information can lead to uninformed and ineffective collection strategies that may alienate customers and damage long-term relationships.

Collections Agents Unaware of Customer Situations

The disconnection caused by manual processes and non-integrated systems means collections agents often lack visibility into a customer’s unique situation. For example, a customer might be facing genuine financial hardship or going through a significant life event that impacts their ability to pay on time. When collections agents are unaware of these situations, they may inadvertently apply pressure or use inappropriate collection strategies, leading to a poor customer experience.

A more informed approach to collections would involve segmenting customers based on their circumstances and tailoring communications accordingly. This kind of sensitivity not only helps in recovering debt more effectively but also enhances customer retention and loyalty.

The Cost of Poor Customer Retention

A short-sighted approach to debt collection can lead to poor customer retention. When customers feel that they are treated fairly and empathetically, they are more likely to continue doing business with a company, even after resolving a debt. However, if the collections process is perceived as aggressive or unfair, it can lead to customer churn, damaging the company’s reputation and resulting in lost revenue over time.

Customer retention is critical for long-term profitability. Research has shown that it costs significantly more to acquire new customers than to retain existing ones. Therefore, a well-thought-out, customer-centric debt collection strategy can contribute to a stronger, more loyal customer base.

How CollectXpert Addresses These Challenges

CollectXpert offers a comprehensive, integrated solution that tackles the challenges outlined above. By automating manual processes and providing seamless integration with CRM systems, CollectXpert ensures that collections teams have all the necessary customer information at their fingertips. This integration enables collections agents to make informed decisions, tailor their strategies, and communicate more effectively with customers.

Moreover, CollectXpert’s platform includes advanced segmentation capabilities, allowing businesses to classify customers based on their payment behaviours and circumstances. This approach enables more personalised and empathetic communication, improving both recovery rates and customer satisfaction. With CollectXpert, businesses can transform their debt collection processes into a strategic advantage, fostering better customer relationships and ensuring long-term success.

In a landscape where 38% of customers don’t pay on time, businesses cannot afford to rely on outdated methods and disjointed systems for debt collection. The shift towards a more integrated, automated, and customer-centric approach is essential for improving recovery rates and maintaining strong customer relationships. CollectXpert provides the tools needed to overcome these challenges, making debt collection more efficient, informed, and empathetic.

By adopting a modern collections strategy with CollectXpert, businesses can not only improve their cash flow but also build a loyal customer base that supports sustainable growth.